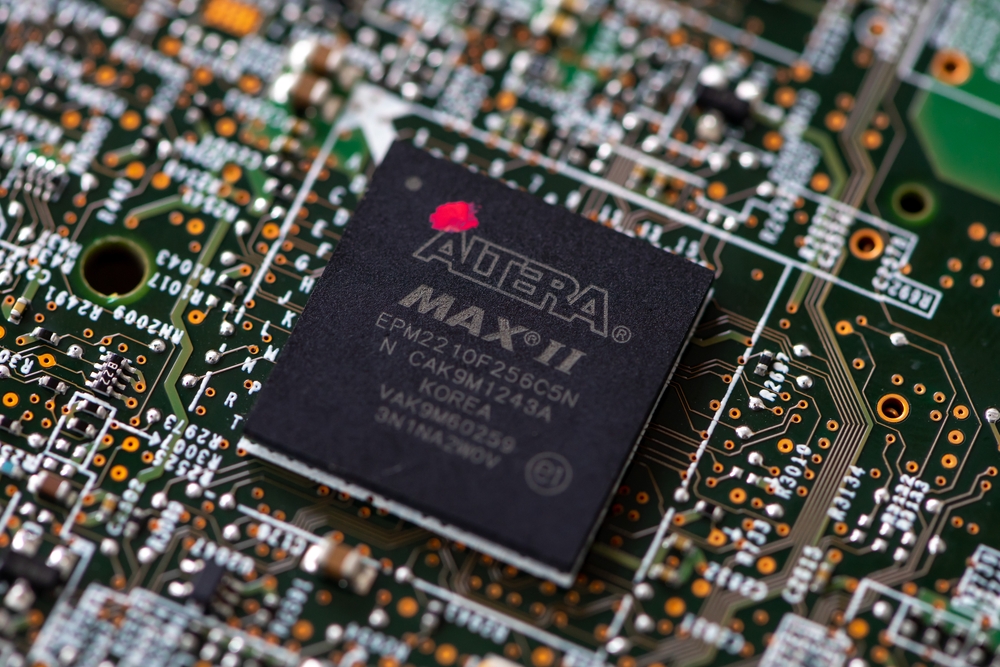

The need to cut costs and Intel’s pursuit of multi-billion-dollar financial resources have sparked various rumors about potential restructuring at the processor giant. Among these rumors was the possibility of selling its subsidiary Altera, which specializes in programmable matrices. However, the head of this division has firmly denied such speculation, confirming that plans for going public remain on track.

Sandra Rivera, CEO of Altera, a subsidiary still dependent on Intel, recently addressed the situation in an interview with CRN. She stated, “We are following a plan that does not include selling Altera in its entirety, but selling a stake in that business, as was planned from the very beginning, which we have been talking about for over a year now, and also going public in 2026.” Rivera stressed that many rumors circulating about the company’s future are unfounded, stating that much of what is being reported “is not from anyone familiar with what is actually happening.”

Separation and IPO Plans Ahead of Schedule

Altera is set to complete its functional separation from Intel by January 1 of next year, with progress on this transition already ahead of schedule. The management at Altera supports Intel’s initiative to sell its stake, as the company prepares for the upcoming deal. Entering the public stock market through an IPO remains a significant milestone for Altera’s future development, scheduled for 2026. As part of its long-term strategy, Altera aims to maintain its leadership position within the industry. We’ll keep you updated on any major developments during this transition.

Intel acquired Altera in 2015 for $16.7 billion, and a key question remains—will the IPO justify Intel’s investment? Since last year, Intel has been working to structurally separate Altera, preparing it for its public debut. These intentions were made clear in October of last year, and Intel confirmed in February that Altera would reclaim its name after functioning under Intel’s Programmable Solutions Group since the acquisition, notes NIX Solutions.

Competing with Xilinx and Market Implications

The revival of the Altera brand holds strategic significance, especially considering that competitor Xilinx was acquired by AMD in 2022. Altera’s reentry into the market as an independent entity brings symbolic meaning for its management team. Following the IPO, Intel expects to retain a majority of Altera’s shares, although it is unclear whether these plans may evolve as the process unfolds.